Social Impact Project and NGO FAQs

The following FAQs have been jointly created by Launchnodes and GiveDirectly

Questions about Stablecoin for Impact

1. What is stablecoin yield donation?

SFI uses yield generated from stablecoin lending to fund social impact causes in data-rich contexts - such as climate action, inequality reduction, and infrastructure development.

2. How does Aave impact yield work?

SFI allows individuals and institutions to deposit stablecoins - USDT, USDC, or DAI, into secure, overcollateralized lending pools on Aave. These deposits earn yield as borrowers pay interest to access the liquidity. Users can choose to donate a portion (or all) of their generated yield to vetted social impact organizations listed in the Social Impact Marketplace (SIM). Importantly, users retain full control over their original capital and can withdraw it at any time. The donated yield is streamed to NGOs on a regular basis, providing them with a new, sustainable source of funding, powered by DeFi, without requiring donors to give up their principal.

3. How does SFI benefit e.g. GiveDirectly?

SFI benefits GiveDirectly by letting people who supply USDT/USDC/DAI to Aave lending pool, donate a portion of their supply rewards to support direct cash transfers.

Here's how it works:

Supply Rewards: When someone supplies their USDT/USDC/DAI, they earn interest over time.

Donating Rewards: Instead of keeping all the rewards, the lender keeps their principal and can choose to donate a percentage of their lending yield to GiveDirectly.

Long-Term Support: Because the lender keeps their original investment and only donates the rewards, the support for GiveDirectly can continue over a longer period compared to a one-time donation.

4. Are there any minimum requirements for using SFI?

Stablecoin for Impact allows you to supply as little as 1 USDT/USDC/DAI and point some percentage of the rewards to GiveDirectly. Users can select the amount of rewards they would like to donate from 1-100%.

5. What are the technical requirements for having a SFI listing?

Technical requirements:

Ethereum Wallet: You need an Ethereum wallet that can receive supply yield in the form of USDT/USDC/DAI.

Application: You must complete an application to have your social impact project listed. This application ensures that your project meets all the necessary criteria and includes all required details.

Public Information: The information you provide in your application will be publicly available as part of your listing.

6. What is the long-term vision for the SFI initiative, and how does our NGO fit into this vision?

The long-term vision for SFI is to create a financial tool that funds social impact for the long term in data rich contexts. We believe that Ethereum will become an important general-purpose technology and stablecoin lending will become an important sustainable financial tool that allows donors to support social impact work for the long term by not having to give away their principal capital or losing custody of it. By participating in this initiative, GiveDirectly is testing and advancing this innovative approach to attract new funding sources and strengthen support for direct cash transfers, using stablecoin yield to create a lasting impact.

Questions about Participation and Requirements

1. How can organizations get listed in the social impact marketplace?

Organizations can get listed on the Social Impact Marketplace by applying online.

2. What criteria are used to evaluate organizations for listing?

The following LIS marketplace form lists out all the requirements that applicants need to conform by: https://7lftpmcph2j.typeform.com/to/lytD1NJu.

3. What types of projects are eligible for funding through SFI?

Any project that meets the SFI marketplace requirements can list on social impact Marketplace. The SFI and Lido staking community will support projects that clearly demonstrate an effective use of stablecoin yield that drive social impact. Projects and programs must be designed with an understanding of how stablecoin lending yield works. This understanding should be reflected in the financial model submitted as part of your application to the Social Impact Marketplace. The model will be made publicly available for all SFI participants to review. It should demonstrate how your organization will deliver impact even when yield levels fluctuate, and must assume periods of lower returns while maintaining measurable outcomes. Connect with Launchnodes to learn how your project can begin receiving funding through Stablecoin for Impact. The team is available to answer any questions you have about eligibility criteria. Book a call!

4. What kind of projects will the funds support?

Stablecoin for Impact is designed to fund projects that are fighting climate change reducing inequality and building infrastructure to make the world a better place

5. What kind of reporting will our Social impact project need to provide?

SFI does not require any specific monitoring and evaluation. Rather, it requires existing monitoring and evaluation data to be made public as part of the listing in the social impact Marketplace to encourage existing donors to maintain their support and for new donors to pledge additional stablecoin lending yield to your project. If the impact of your project is not measurable, evidence-based and compelling, it is unlikely that it will be supported by impact donors.

6. Can our social impact project partner with other organizations for joint projects?

Yes

Questions about Donations and Impact

1. Can donors track the impact of their contributions?

Yes, donors can track the impact through data provided by the social impact project listed in the Social Impact Marketplace. Additionally, SFI has a macro dashboard that shows how all deposit returns are being used and the overall impact created by LIS.

In the future, LIS will offer a dashboard where individual donors can see the impact of their contributions. This will include a summary of all the causes they support and how their yield contributes to each cause.

2. How does stablecoin lending yield get converted into donations?

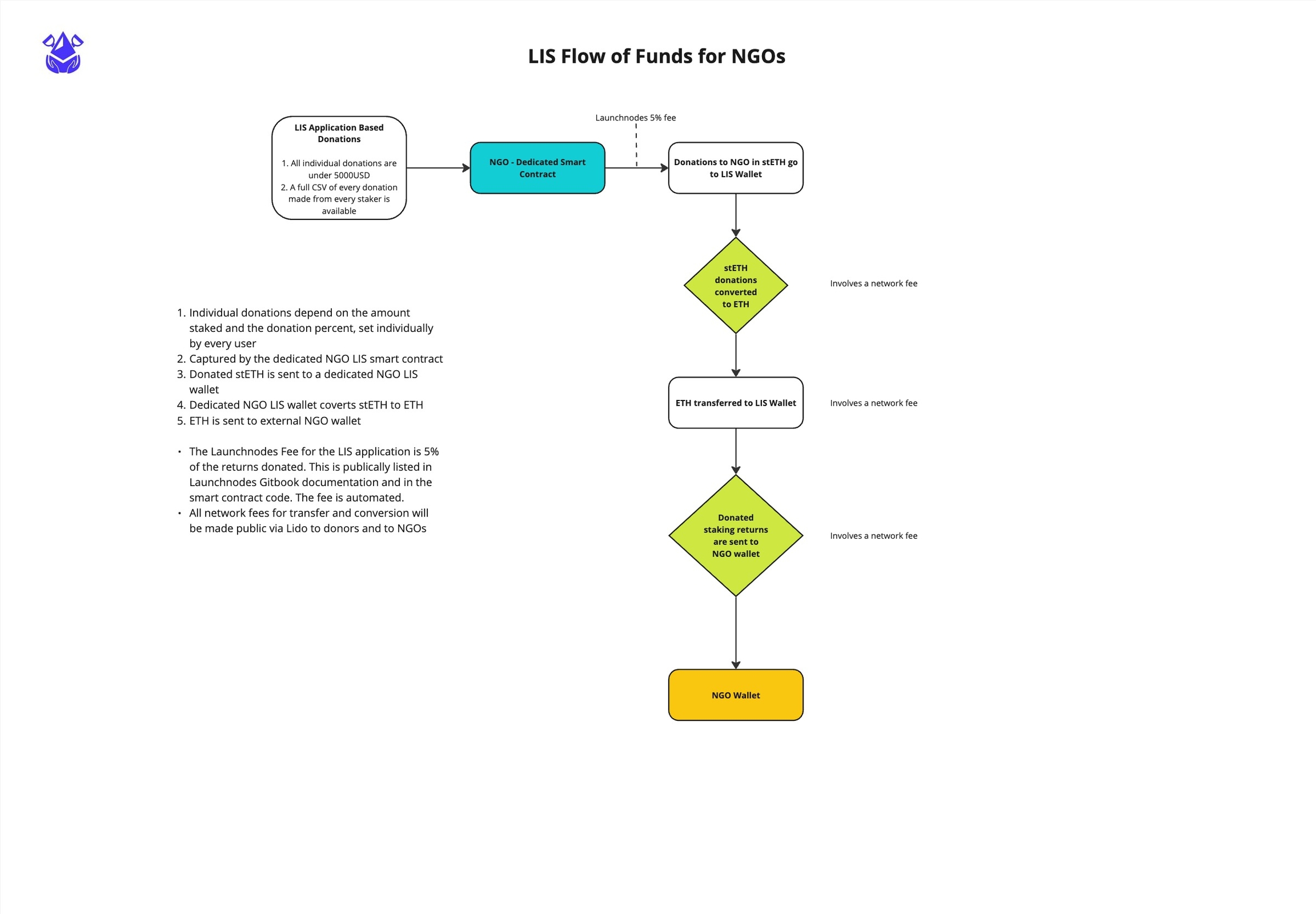

Once your project has been successfully onboarded to the Social Impact Marketplace, you will be asked to provide a wallet address capable of receiving stablecoins (USDT, USDC, or DAI). This address will be included in a smart contract enabled by Launchnodes, ensuring that any yield donated to your project is sent directly and securely, Launchnodes does not custody any donated funds.

Contact Launchnodes if you need support receiving stablecoins, converting to fiat, or have any questions about the donation flow.

3. Are there any fees associated with impact staking?

4. How does SFI ensure transparency and accountability in the distribution and use of lending yield?

The SFI smart contracts developed are public and can be viewed for each social impact project on the social impact marketplace. Donors can transparently see the projects they are supporting and the amount they are contributing through returns. Likewise, each project can track how much each donor is contributing to their cause and monitor daily earnings. All transactions and earnings are publicly accessible on Etherscan, where anyone can view the data by entering a donor's wallet address or the smart contract address.

5. Are donations tax-deductible?

Donations on SFI and Impact staking are tax deductible. See legal opinion here.

Tax considerations for US-residents: Donors can potentially deduct the value of their rewards donated to a charity, but they must ensure the charity is recognized as a tax-exempt organization to qualify for deductions.

Impact Stakers can generate a report on LIS that provides details on each cause they have supported and the total amount donated over a specified period. This report can be used to calculate the total donations made during that time and determine any tax deductions applicable to those donations.

6. What is the timeline for delivering funds to an NGO?

Once a social impact project goes live on SFI, it will receive daily supply returns donated to it, provided the project can accept USDT/USDC/DAI directly. If the project requires third-party conversion, donations can be organized on a monthly or weekly basis, depending on the third party selected and the associated costs.

Questions about Risks and Security

1. How secure are a donor’s supplied stablecoins?

SFI is built on Aave, one of the most trusted and widely used decentralized lending protocols in DeFi. Aave allows users to deposit stablecoins - USDT, USDC, or DAI, into collateralized lending pools, where borrowers must provide a collateral to borrow funds. This structure significantly reduces the risk of loss, even if a borrower fails to repay, making it a secure and predictable way to generate yield.

To safeguard users and their funds, Aave undergoes regular smart contract audits and maintains a robust risk management framework. It also features transparent governance, on-chain metrics, and safety modules to mitigate the impact of extreme market volatility.

SFI leverages this infrastructure to ensure that yield is generated in a secure, scalable, and transparent environment, allowing users to support social impact without compromising on financial safety.

2. What are the potential risks associated with stablecoin lending for our NGO, and how can we mitigate them?

The primary risk for projects receiving funding through Stablecoin for Impact is the variability of lending yields, which can fluctuate based on market conditions such as borrowing demand on Aave. While the value of stablecoins (USDT, USDC, DAI) remains relatively constant, the amount of yield generated may vary over time, potentially affecting the scale or timing of impact delivery.

If your organization expects to receive substantial yield-based donations, it’s important to plan for variable inflows. Risk mitigation strategies, such as conservative budgeting, reserve planning, or collaborating with partners for financial forecasting, can help.

Please contact the SFI team at Launchnodes if you’d like to explore risk management approaches or work with third-party partners to design a yield-resilient funding model.

3. What happens if the stablecoin lending pool service provider experiences technical difficulties or financial instability?

Aave is one of the most battle-tested and secure DeFi lending protocols, with billions in total value locked and a long track record of uptime, transparency, and rigorous smart contract audits. However, like any technology or financial system, it is not entirely risk-free.

If Aave experiences technical difficulties (e.g., a temporary outage or interface issue), user funds remain secure in the smart contracts and are not lost. Deposits are non-custodial and can typically be withdrawn once the issue is resolved.

In the unlikely event of deeper financial instability (e.g., smart contract vulnerability, liquidity crisis, or market shock), Aave has several risk mitigation mechanisms in place. These include overcollateralization requirements for borrowers, automated liquidation systems, and a Safety Module, a decentralized insurance-like pool funded by depositers that can be used to cover shortfalls.

SFI continuously monitors the performance and health of Aave’s lending pools. We are also actively exploring risk diversification strategies and may integrate additional lending protocols in the future to minimize reliance on a single provider.

If you are a participating organization and have specific concerns, our team is available to walk you through risk scenarios and help you build resilient financial models.

6. How can our NGO ensure compliance with local and international regulations while participating?

SFI assumes that projects and organizations receiving funds will manage their own compliance and regulatory requirements, typically through their legal and compliance teams. For specific guidance on regulatory issues or jurisdictional concerns related to your project or organization, please contact the LIS team and we can support specific questions or issues you may have.

Last updated